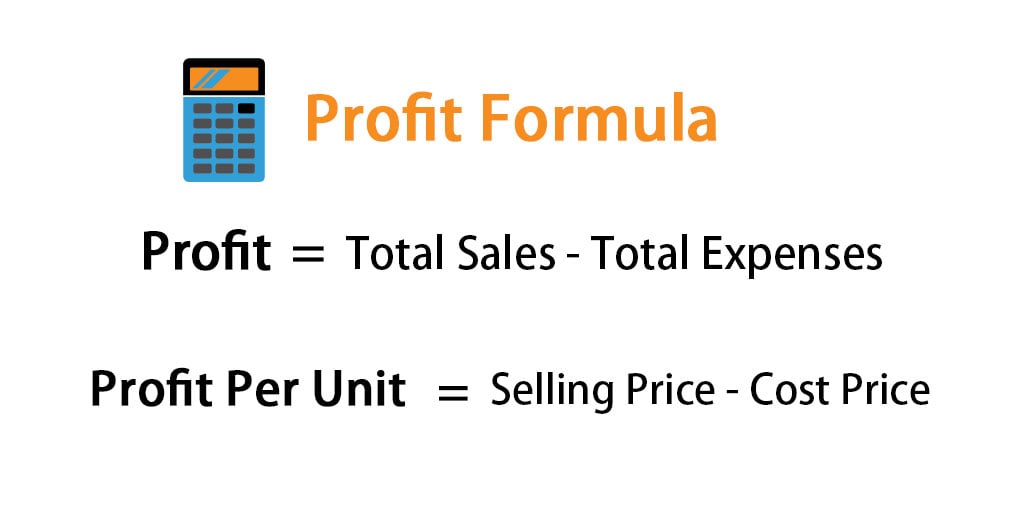

Profit amount formula

Example 1 Sues Shoes took 150000 in sales in 2018. You can use the formula below to.

Gross Profit Margin Formula Meaning Example And Interpretation

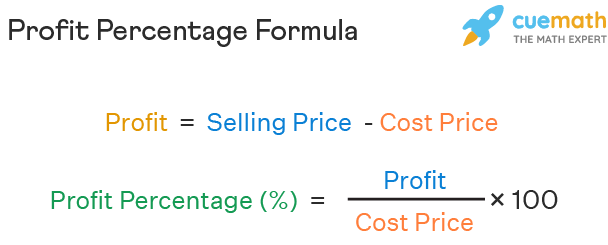

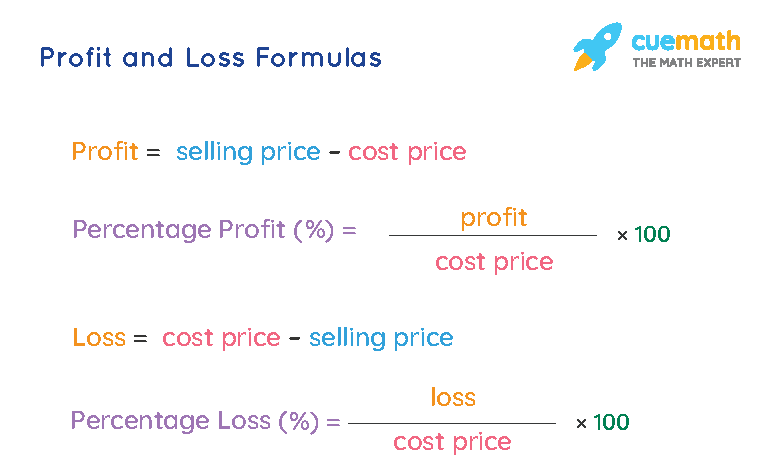

So the profit will be the difference between the selling price and cost price.

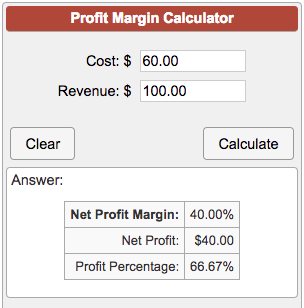

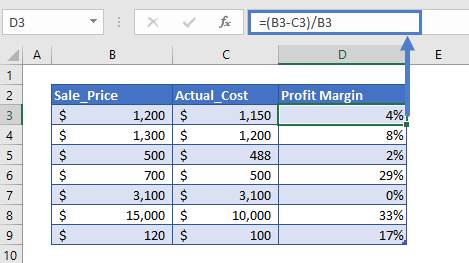

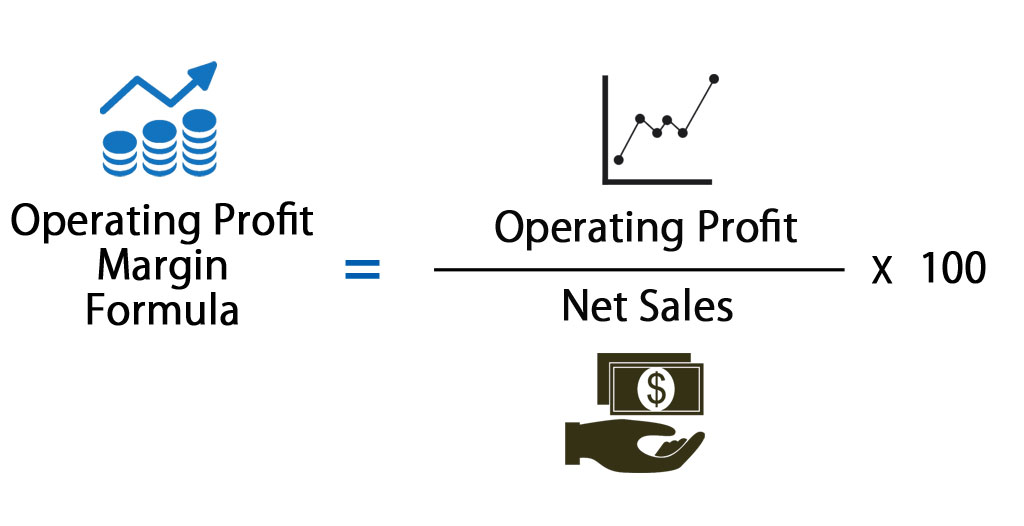

. Net Profit Margin Net Profit Revenue. The basic formula that is used to calculate the profit in a business or a financial transaction is. Gross profit margin Net sales COGS Net sales 2.

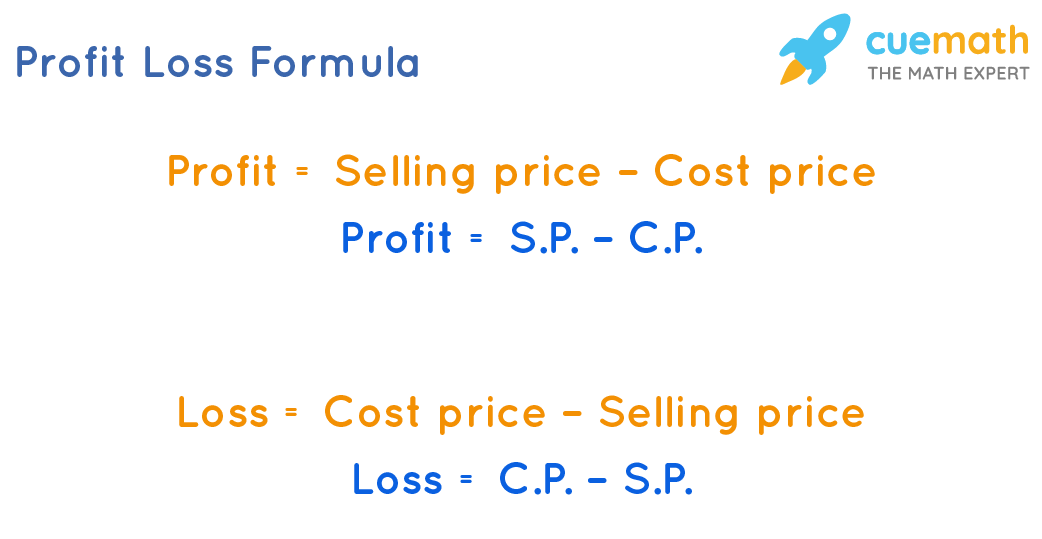

LossLoss is always calculated on the. Profit or Gain Selling price - Cost price Profit 125 - 100 Profit Rs. So by selling the book to the student the.

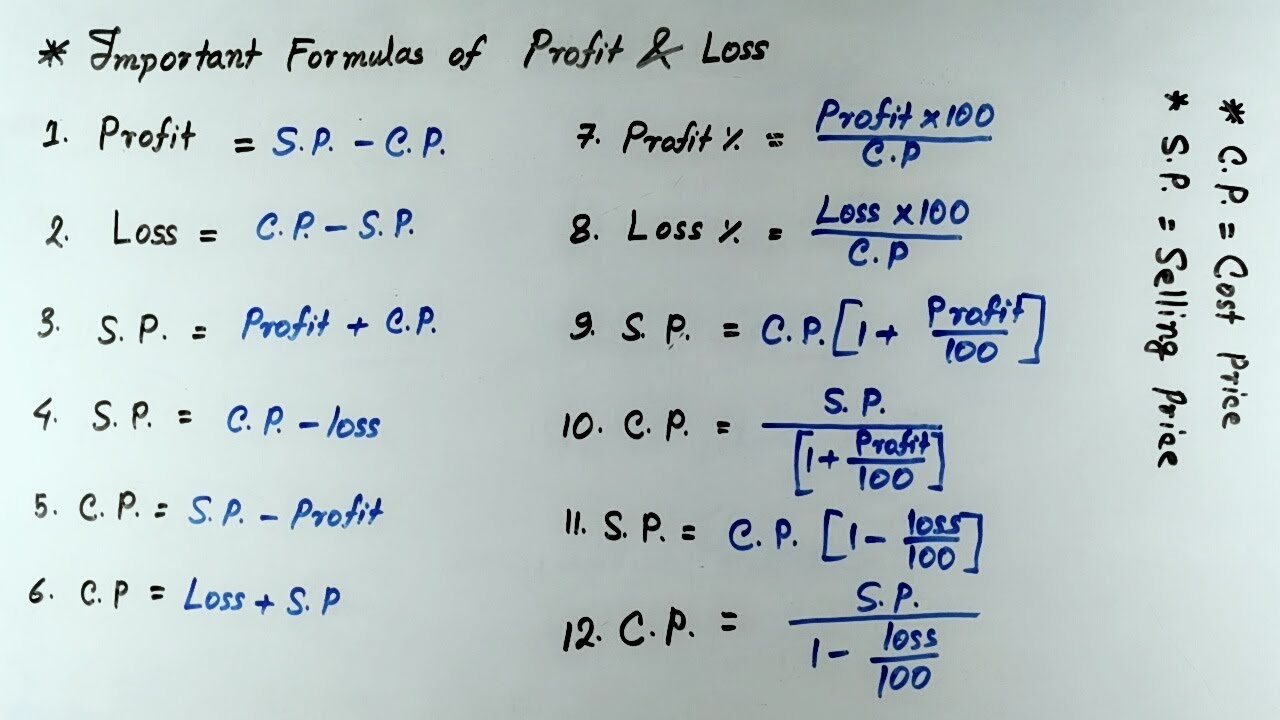

Gain Gain CP 100 Loss Loss CP 100 SP 100 Gain 100 CP SP. Net Profit Margin Net Profit Revenue Using the income statement above Chelsea would calculate her net profit margin as. Using the profit and loss formulas we will calculate the selling price of the calculator.

The profit margin formula Profit margin ratio Net income Net sales Lets go through a couple of examples. The formula below calculates the number above the fraction line. Divide this result by the.

Another example would be the following. Profit Margin Net IncomeNet Sales x 100 To calculate gross profit youll need to subtract the cost of goods sold COGS from revenue. Profit is the amount that a seller earns when the selling price is greater than the cost price.

Loss is equal to cost price minus selling price. But you can also use. Using the formula for profit percentage Profit Profit CP 100.

Profit Selling Price - Cost Price. Given CP 720 and Loss 6. This is the simple formula for calculating net profit.

GainProfit is always calculated on the SP selling price. Now let us find the profit formula and loss formula. This is called the gross profit.

If loss is 6 it means that if the cost price is 100 the loss. For small business owners going on gross profit. Net profit Total revenue - Total expenses.

To calculate the gross profit margin use the following formula. In this article we discuss what profit is and what it says about a business and then we provide an example of how to calculate profit. Here Cost Price CP of a product is the cost at which it was.

For gross profit gross margin percentage and mark up percentage see the Margin Calculator. The gross profit formula is as follows. Net profit Gross profit -.

How to calculate profit. So the profit percentage of the shopkeeper will be 25 20 100 125 100 125. Subtracting earnings before taxes by the taxed amount 2440 854 1586 leaves you with the accounting profit.

It can be said that the shopkeeper. Below is the list of some basic formulas used in solving questions on profit and loss. The profit or gain is equal to the selling price minus the cost price.

Profit or Gain Selling. What is the formula for net profit. 12500 55000 23 In other words for every dollar.

Net Profit Revenue - Total Costs Total Costs Cost of Goods Sold Taxes Overhead Expenses Total Costs 320 200 300 Total Costs 820 Net Profit Revenue - Total. Where Net Profit Revenue -.

Profit Formula Calculator Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Formula What Is Profit Formula Examples Method

Find Sale Price When Profit Percentage And Cost Price Is Given Youtube

Profit Margin Calculator

Profit And Loss Formula Examples Derivation Faqs

Profit Percentage Formula Examples With Excel Template

Profit Margin Calculator In Excel Google Sheets Automate Excel

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit And Loss Formula Definition Calculation Examples

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Loss Profit And Loss Important Formulas Youtube

Profit Margin Formula And Ratio Calculator Excel Template

Gross Profit Percentage Double Entry Bookkeeping

Profit Formula Profit Percentage Formula And Gross Profit Formula

Operating Profit Margin Formula Calculator Excel Template