Social security wages calculation w2

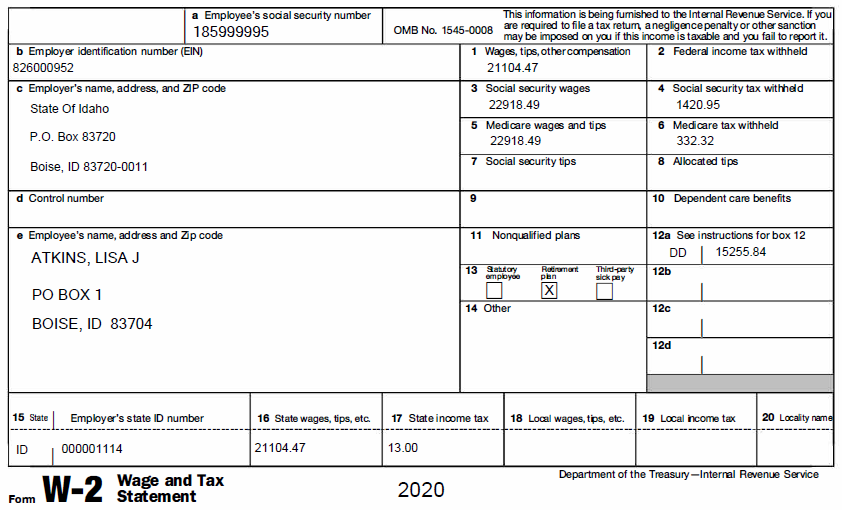

For more information on how to calculate the federal withholding amount please see TSOP 301. This amount should be equal to the amount shown on your W-2.

Your W 2 Employees Help Center Home

1 Use Our W-2 Calculator To Fill Out Form.

. Determining a Valid Social Security Number. Thats your wages that are subject to the Social Security portion of FICA as opposed to the Medicare portion which is in Box 5. However there is a maximum amount of wages that is.

If your box 3 amount differs from box 5. Updated December 06 2020. The net amount of this calculation should equal the taxable wages reported on your W-2 for social security box 3 and Medicare box 5.

Knowing how to calculate your. Use Our W-2 Calculator To Fill Out Form. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable.

Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 100 Free. Ad Deciding When To Claim Your Social Security Benefits Can Be Tricky. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit.

Ad 1 Use Our W-2 Calculator To Fill Out Form. Some employees may see a difference between Box 1 Federal Wages. Answer 1 of 2.

There is a three-step process used to calculate the amount of Social Security benefits you will receive. So benefit estimates made by the Quick Calculator are rough. Why is Box 1 and Box 16 different on my W-2.

We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. File Online Print - 100 Free. Calculate Medicare and Social Security Taxable Wages.

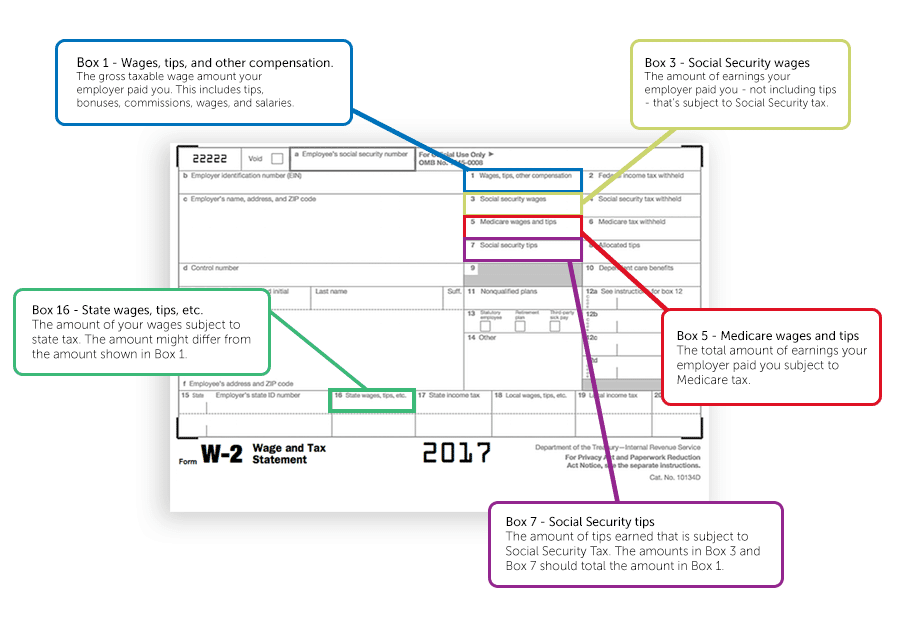

Box 3 reports the total amount of your wages subject to Social Security tax. Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points. Publication 15 Circular E Employers Tax Guide--Reporting Sick Pay.

Social Security Number Randomization Frequently Asked Questions. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. Social Security wages are an employees earnings that are subject to federal Social Security tax withholding 62 for the employer and 62 for the employee for the 2020 tax year.

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. The resulting amount should equal Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2. Social Security wages are those earnings that are subject to the Social Security portion of the FICA tax.

If you find that after making these adjustments to your Gross Pay YTD per your final. Ad Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free. 2 File Online Print - 100 Free.

I assume youre referring to the Box 3 amount. Ad 1 Use Our W-2 Calculator To Fill Out Form. You can get free copies if you need them for a Social Security.

2 File Online Print - 100 Free. Use your earnings history to calculate your Average Indexed. As a salaried employee you are required to pay federal income tax Social Security tax Medicare tax and if applicable state and local income tax.

2 File Online Print - 100 Free.

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Read Your W 2 Form To Correctly File Your Tax Returns

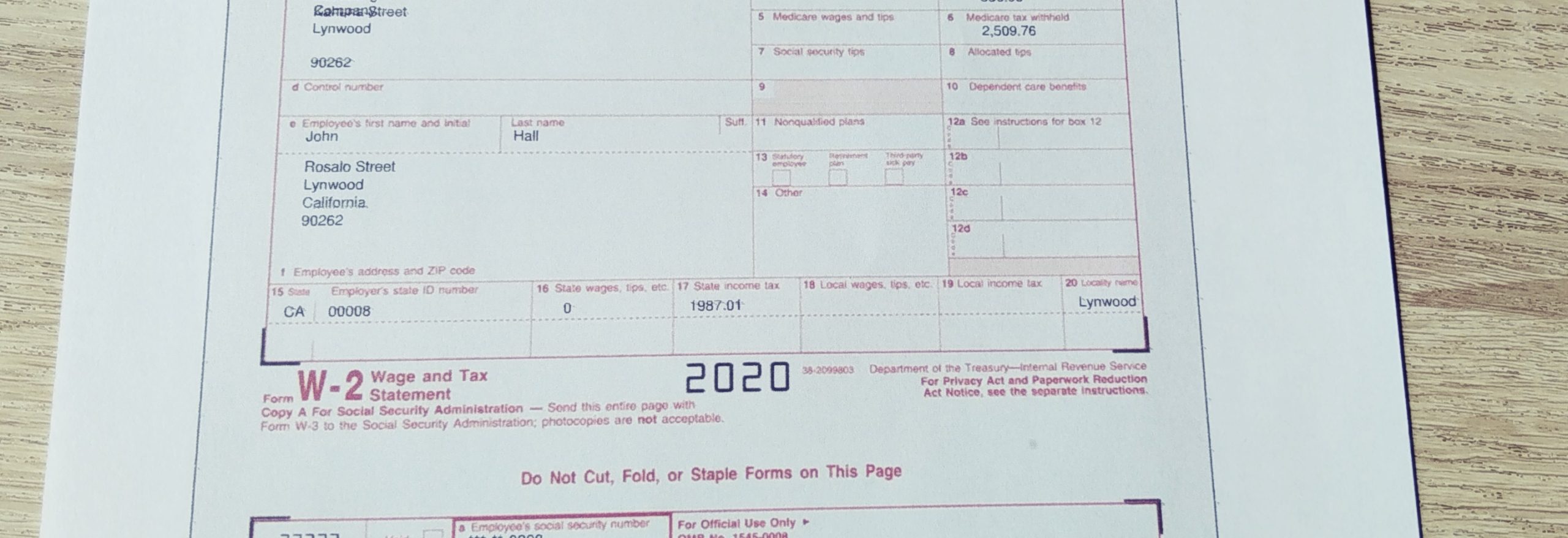

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

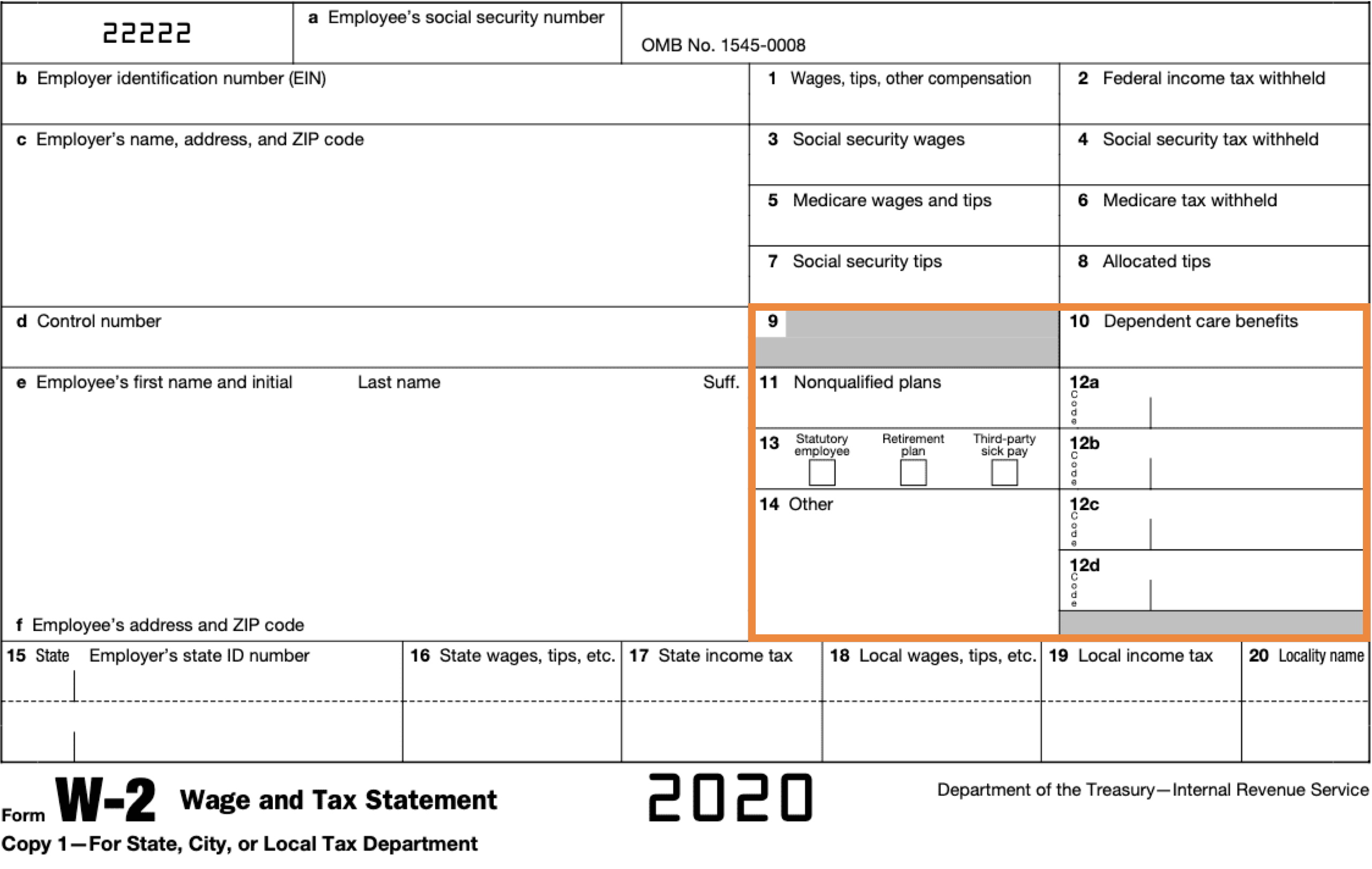

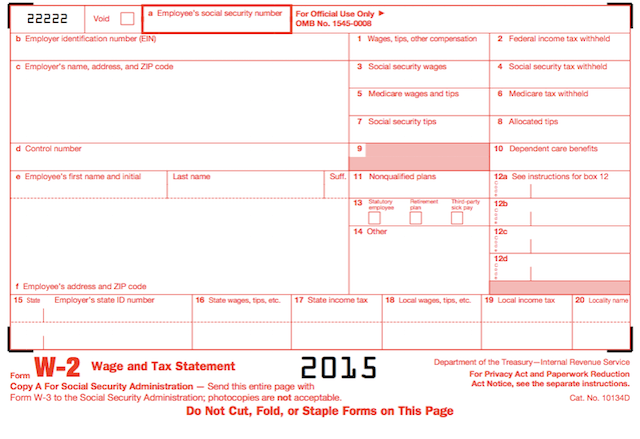

Reading Your W 2 Wage And Tax Statement

A Quick Guide To Your W 2 Tax Form The Motley Fool

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Calculate W2 Wages From Paystub Paystub Direct

Solved W2 Box 1 Not Calculating Correctly

Form W 2 Explained William Mary

Understanding Your W 2 Controller S Office